CAUTION: This article is for informational purposes only and should not be construed as investment advice. We also warn that automatic trading is of high risk. In addition to technical issues, there may be a human factor on the side of a followed trader.

Social trading is a fusion of social networks and online trading on the financial markets. It boils down to copying (mirroring) experienced traders' deals. Unsurprisingly, it has quickly gained traction with novice traders as it does not require sophisticated decision making. Yet keep the risks in mind. Social trading platforms are the gateway to this approach.

The most challenging thing is to choose a befitting signal provider to follow. By selecting the right trading platform and signal providers, duly dealing with risk management, one can raise profits, or at least prevent the loss of deposit funds. For financial terms, notions and specifics - find the FAQ section at the end.

3 trading concepts and differencesMirror trading, social trading and copy trading are often confusingly thought of as the same thing. Let's elaborate on the actual differences.

In mirror trading an algorithmic trading strategy (robots) is applied. Transactions take place on trading servers, not on the user (investor) side. A user evaluates automatic strategies, selects one, and monitors it in his account.

Copy trading is similar, except users follow real traders who share signals via a trading platform that logs all transactions. An investor views it and chooses to repeat whichever action. A trader sending signals is called a signal provider, though he can use an auto-trading bot as well. Transactions take place on a trader's device.

Social trading is a common umbrella term for copy and mirror trading strategies. We may perceive it as an exchange of ideas about markets and trends. Traders share their insights and operations, comment on the actions of others, etc. It mainly takes place in social networks, instant messengers, and niche websites such as TradingView.

The best platforms for social trading

We've selected 8 diverse social trading platforms in terms of trading concept (mirror, copy), regulation (UK, USA, Cyprus, etc.), minimum deposit requirements ($1, $200, $500), signal providers (dozens to thousands).

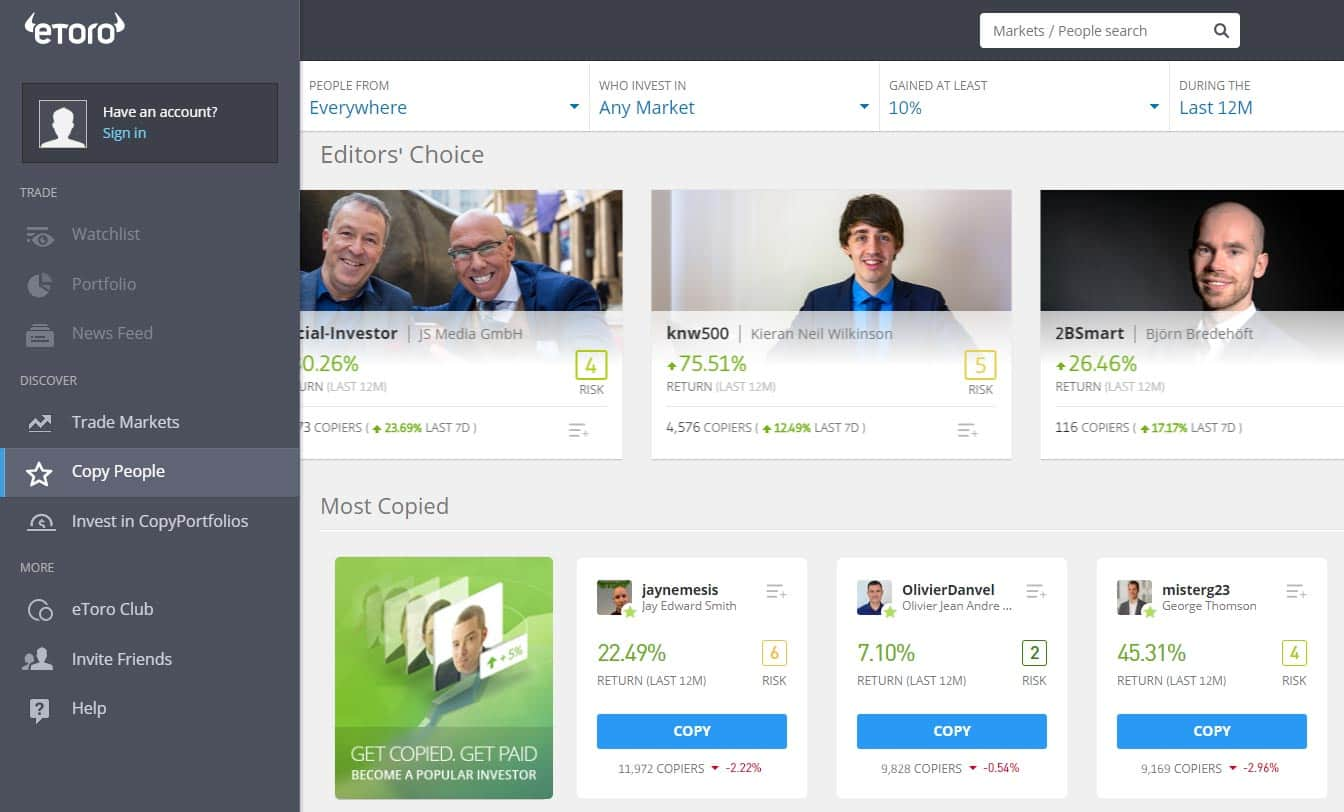

1. eToro

Warning. 68% of retail investor accounts lose money when trading CFDs with eToro. You should consider whether you can afford to take the high risk of losing your money. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees. Also, this content is not intended for US users. eToro USA LLC does not offer CFDs, only real Crypto assets available.

eToro Group Limited was founded in 2007 in Cyprus (with offices in England and Israel). Positioning itself as a web-based trading platform, it is primarily a CFD and Forex broker, and, one of social trading platforms since 2016, inherently. It's Copy Portfolios feature involves Machine Learning technology to optimize performance.

Unlike most copy trading platforms, eToro does not offer signal providers and brokers separately, eToro is a broker in itself. Despite regulation in the UK (FCA), Australia (ASIC), and Cyprus (CySEC), eToro is not listed on any stock exchange, does not provide annual reports, and does not have a parent bank.

To start working, one has to bring a minimum deposit of 50 USD. For US clients are available only real Cryptos and ETFs products only. Statistics for each signal provider is open to each user, and it is informative and visually pleasing.

eToro warns that social trading tools it provides are just for informational purposes. Also, we like the fact that it actively cautions about the risks of losing savings. However, the inability to limit the risks when copying signal providers is a significant drawback.

Pros- Is among top social trading platforms

- Informative web page

- Easy to get started

- Still in the early stages

- No risk limitation for social trading

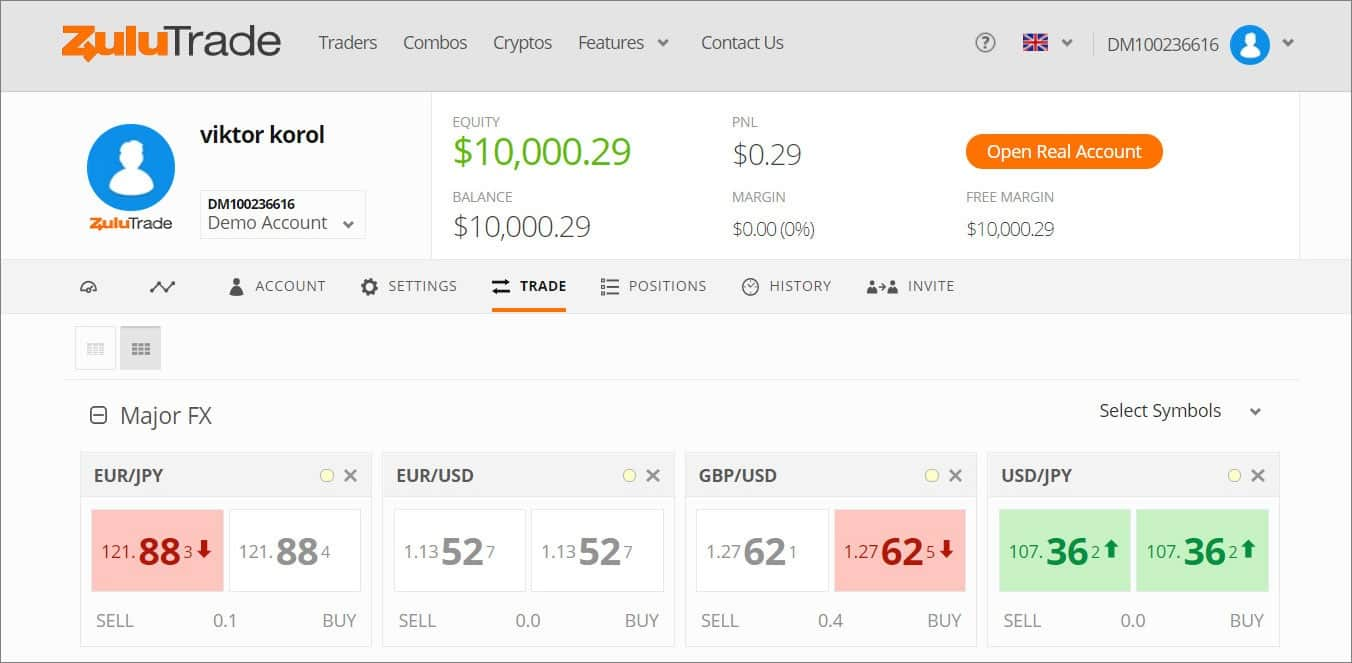

2. ZuluTrade

ZuluTrade was founded in 2007 in the United States. In March 2015, it received the European portfolio management license. ZuluTrade is an online social platform for copy trading, granting access to investment strategies of Forex trading experts, performance ratings. And, of course, allowing to monitor and copy other traders. Trading includes stocks, binary options, goods and indices (NASDAQ).

The platform lets you manage trading with several unique features such as Zulu Guard, Lock Trade, and Zulu Script.

Lock Trade - to check transaction execution after receiving a signal.

Zulu Guard - to automatically disable a signal provider if strategy changes.

Zulu Script - to create scripts with specific criteria for auto transactions.

Zulu Rank - an algorithm ranking traders by multiple factors.

The minimum deposit amount depends on a broker working through ZuluTrade, e.g. AAAFx, Pepperstone, FXCM, etc. Some require as little as $1, yet the average is 200-300 USD ( Broker list). ZuluTrade also supports MetaTrader accounts. As for fees and commissions, brokers charge a fee for linking an account to ZuluTrade - up to 3 pips.

The distinguishing feature of ZuluTrade is the number of traders to copy. Although we could not find the exact number, it exceeds several thousands, possibly tens of thousands. Another important feature is the ability to create a portfolio of interacting traders who trade similar strategies. A portfolio can also be shared publicly.

There are 2 types of accounts: classic - trade as a signal provider and/or use other signal providers, and profit-sharing (follower) - for beginners to copying others. Signal providers receive compensation when followers make profit, and a penalty in case of loss, respectively. Both types of accounts are also available as demo.

To wrap up, ZuluTrade is not a trading platform. Investors connect MT trading accounts to ZuluTrade - available as Android, iOS and web application. It provides statistics and risk assessment.

Pros- Leading copy-trade service

- Works with the AAAFx broker without commissions

- Transparent signal provider statistics

- The risk of losing capital

- Unavailable for US residents

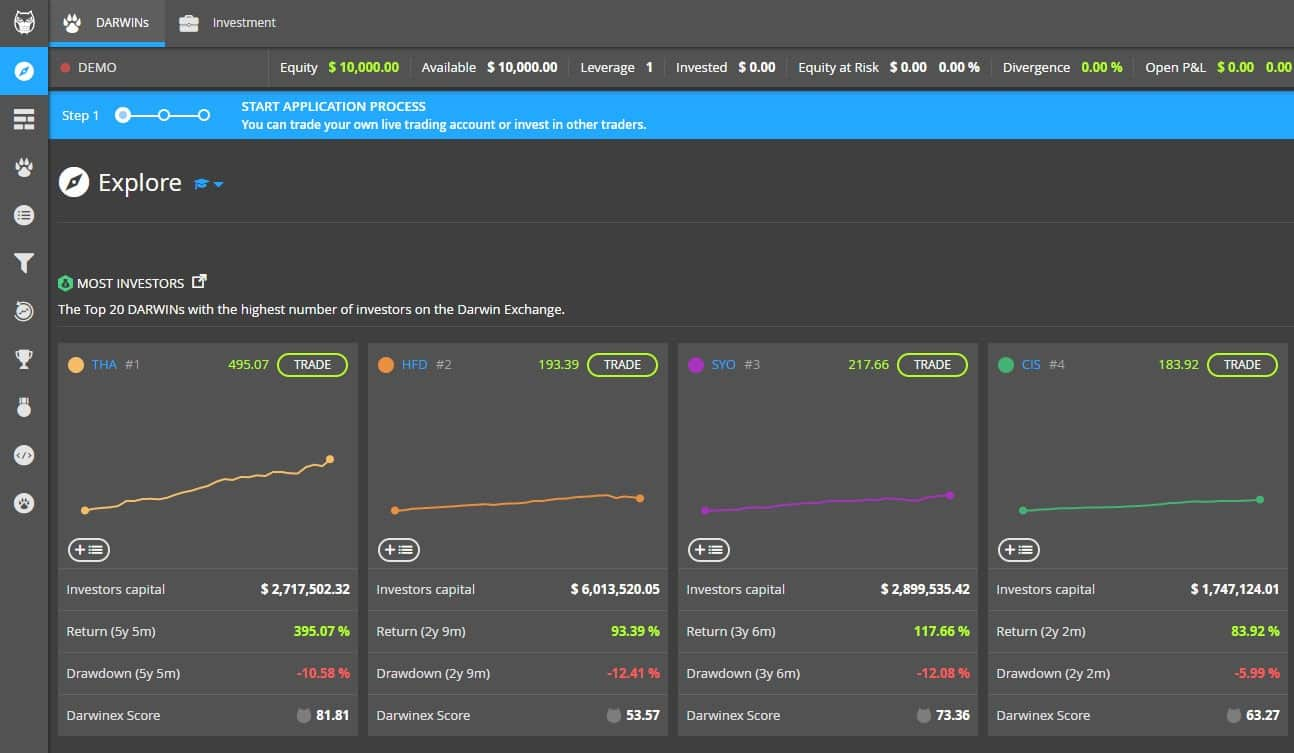

3. Darwinex

Darwinex (formerly TradeSlide) is a British broker headquartered in London and managing social trading assets, founded in March 2012. As any well-regarded broker, Darwinex is regulated by the UK financial market (FCA). It's social platform is called DARWIN and it provides both mirror and copy trading tools.

Stats for each algorithm are quite comprehensive. Trader strategies can be evaluated in terms of risk, performance, experience. A great advantage is the risk limiting option available, namely setting a max loss amount per month, e.g. $100.

The signal copy service by Darwinex differs from conventional social trading platforms. As you are invited to copy trading strategies, the initial index is 100, and it increases or decreases (in contrast to Profit/Loss ratio in other brokers).

As for account opening, the minimum deposit is 500 USD, three currencies to choose from (EUR, USD, GBP), via bank transfer, card payment or Trustly payment system. Experienced traders working with Darwinex get the opportunity to mandate transactions by followers' funds, and gain up to 20% from it if profitable.

Pros- Large selection of signal providers

- Setting risk limits

- High deposit amount

- Signal providers deals are hidden

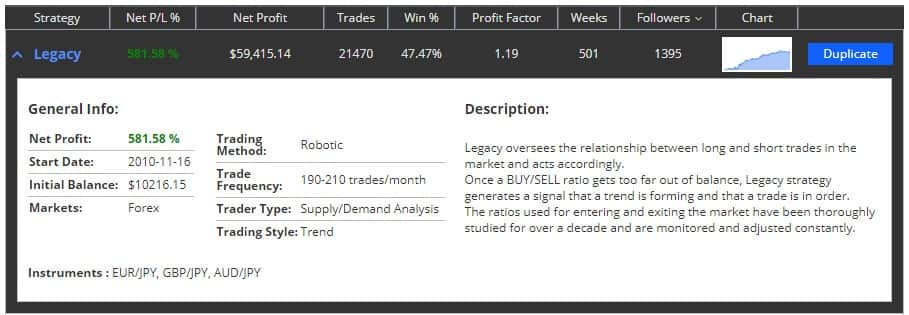

4. DupliTrade

DupliTrade is a web platform for mirror trading. Demo account (14 days) does not require a broker to connect to or a trading account. DT Direct Investment Hub Ltd. manages DupliTrade. They are a licensed Cyprus investment firm regulated by the CySEC: license number 347/17.

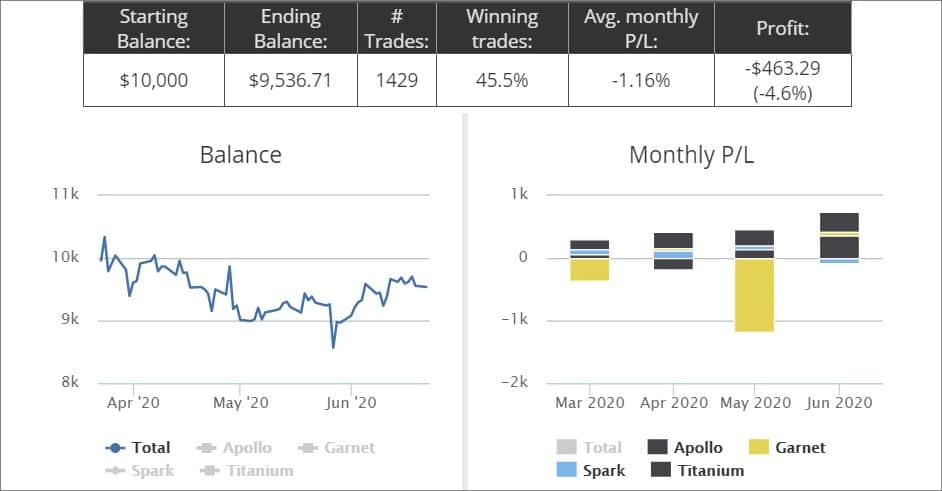

Unlike some fraudulent auto trading projects, DupliTrade does not invent success stories and huge profits. The software is free for anyone, though a minimum deposit is a requirement to start trading. The number of strategies is 12 as of July 2020, all algorithmic. Each strategy has a description, however is somewhat limited ( the entire list).

A trading simulator is available on the website - choose an initial deposit, trading strategy and timeframe (1 month to 1 year). Account reports are informative, but keep in mind that the simulator may be more favorable than the actual trading at any given moment.

Pros- Micro lots are available at all brokers

- Large selection of brokers

- Tech support response time is frustrating

- No limit-risk options

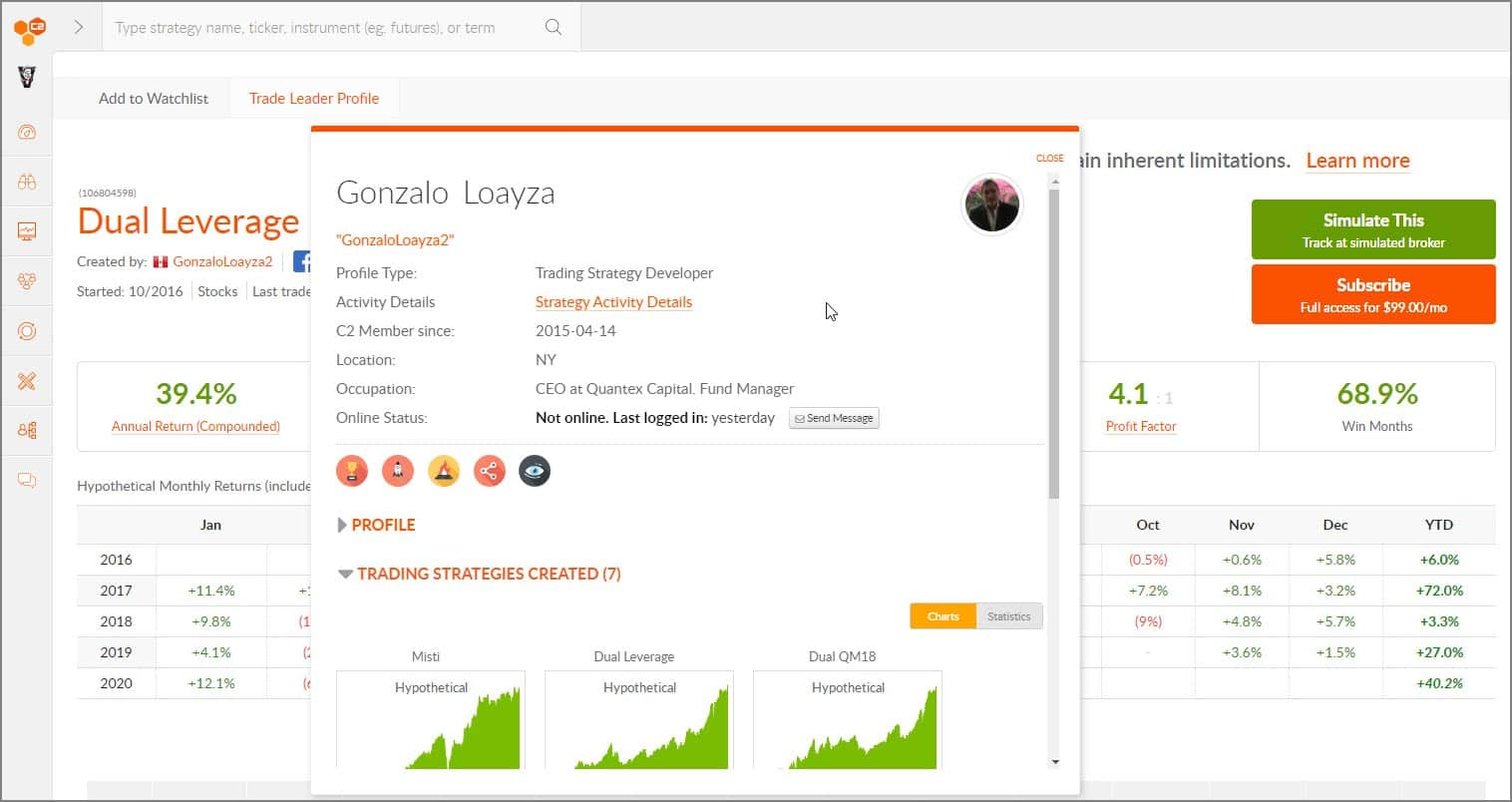

5. Collective 2

Since 2001 Collective2 has been offering algorithmic trading systems on behalf of brokers and retail traders. Our impression about it is ambivalent: on one hand the C2 platform is informative, and there is practically no sociality in it, on the other hand.

The latter is limited to signal provider profiles with strategies, and messaging a trader directly. Activity feed displays new participants, their subscription to strategies, profits and losses, etc. Collective 2 users communicate on the forum mostly.

The data and intricacies for each strategy are extensive, which would be quite tough on beginners. Skilled investors, though, will enjoy useful data, e.g. broker data, correlation statistics, risk assessment, drawdown stats, etc. The pool of signal providers is huge, and most trading strategies require a live account and a fee (0 to 1,000 USD per strategy). C2 subscription costs 49 USD. A 14-day free trial with a demo account is available.

Pros- Statistics on strategies

- Easy to master

- Active forum

- Separate fees for using the platform and strategies

6. FBS CopyTrade

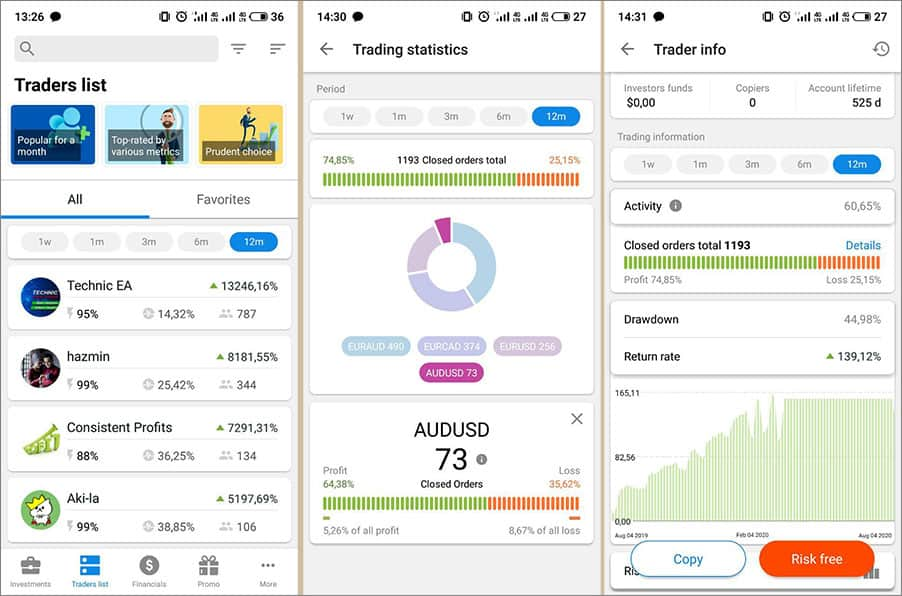

FBS, founded in 2009, is the broker with a stable growth rate, a variety of awards, and global outreach. Currently, the total amount of traders exceeds 14 million in over 190 countries. FBS CopyTrade social platform was launched in 2018, it is a purely mobile platform for Android and iOS. Account sign up is free. Placing a deposit takes place via the app itself, using a payment system of choice (Neteller, Connectum, Bitcoin, Skrill, Perfect Money). The minimum amount and commission depend on which payment system is used.

The app supports authorization using biometrics, it contains five tabs and a chat with technical support. Although, the Viber bot is probably improperly set - it did not answer us. As for signal providers, the list is vast and ever-changing. There's no risk-limiting feature and trader statistics are scarce.

In terms of commissions and fees for using the signal provider, we were unable to find official information anywhere. Please note that you will not be able to use the platform (copy suppliers) until you go through the verification process. The service is not available in the following countries: Japan, the USA, Canada, UK, Myanmar, Brazil, Malaysia, Israel, Iran.

Pros- No minimum deposit

- Mobile platform

- Fast technical support

- No demo account

- No desktop version

- No info on commissions and fees

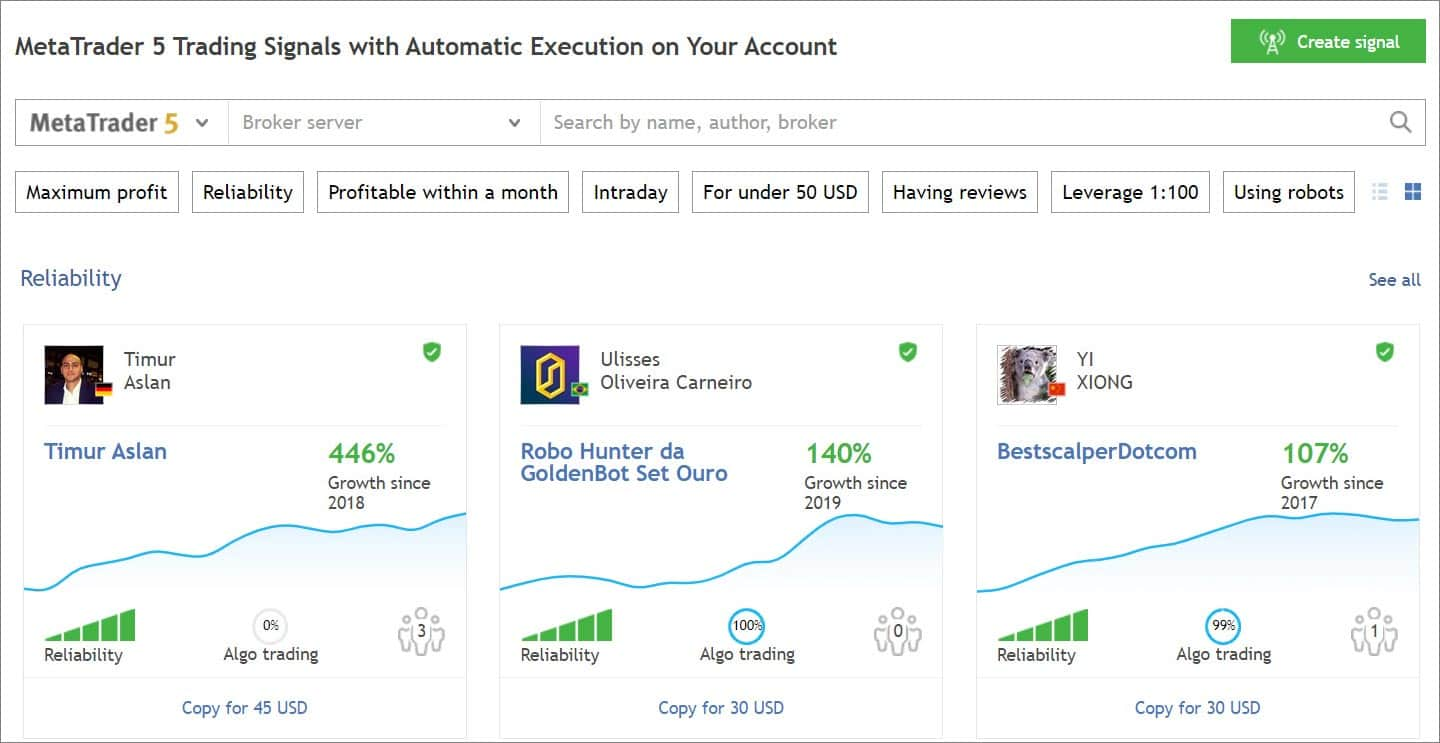

7. MQL5

MQL5 is a copy trading platform connected to MetaTrader 5 and 4 among others. It is free, yet to follow a specific signal provider (trader), one has to pay a fee that varies from 30 up to 500 USD. MQL5 does not offer accounts and does not complete transactions for customers. Essentially, it provides a web portal for trading analysis, social trading, shared hosting service, and some other off-topic extra features.

There is a legion of signal providers, varying significantly - partial or full algorithmic trading, or manual trading, maximum drawdowns and return on investment, and more (visit the MQL5 website). In general, MQL5 seems a peculiar choice. However, do not forget about dishonest signal providers, many of whom do not even set a risk limit.

Pros- Multifunctional platform

- A large choice of signal providers

- Free software

- Capital risks independent of MQL5

8. Tradency

Tradency BVI, founded in 2005, is a financial and technological company, one of the pioneers in mirror trading. Their trading platform, called Mirror Trader, was introduced in 2010 targeting FX traders. It works with third-party brokers, therefore, a minimum deposit depends on the selected broker, in the first place.

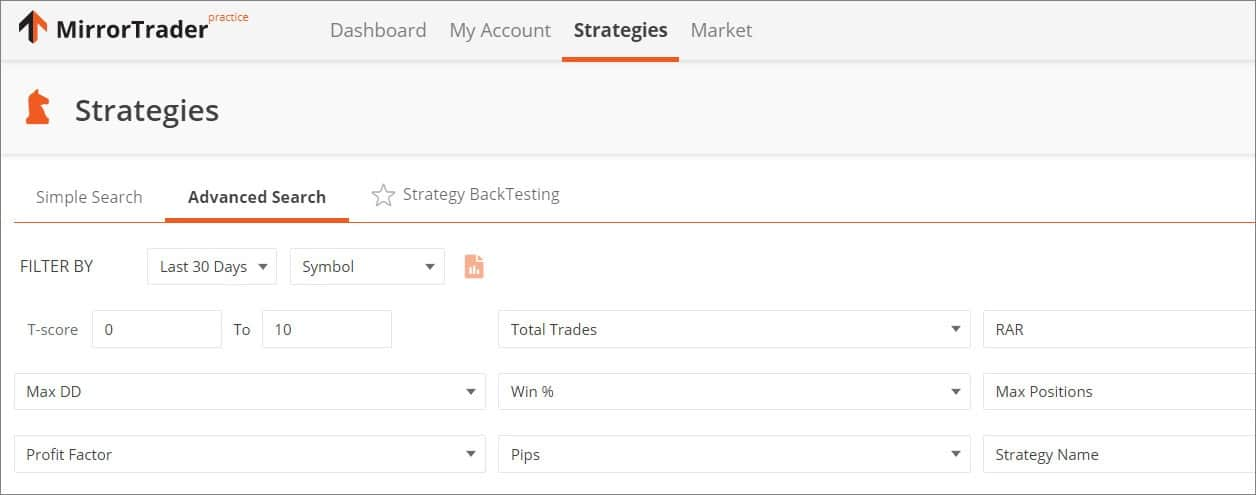

The platform is a web interface supporting seven languages and providing safe demo trading. In general, it is straightforward and should not be a burden for any user. To assess the quality of trading strategies in Mirror Trading, the T-Score parameter is used - the closer it's value to 10, the better the strategy. Although, evaluation parameters behind this system are not known.

Risk management settings per strategy are available, which is quite outstanding. Drawdown is calculated for closed deals only and does not include drawdown for open positions.

Pros- Free demo account

- Risk management for copied strategy

- Informative data

- Each strategy is for one currency pair only

- No social interaction

Summary

Before the advent of social trading platforms traders mainly had to enter the game through brokers. Now, investors can create a portfolio of financial products, as well as signal providers, i.e. traders as a financial instrument.

Investments are made by copying traders who have proven profitability and who allow replicating deals automatically. New companies are emerging in mirror/copy/social trading, yet only a few offer high-quality services.

As for signal providers, it is more complicated. There's no real data on investor losses (no matter what you might see or hear), our impression is that it's about 90% on average. Compared to CFD trading, for example, with an average of 80% of investor deposit losses, trust management is more treacherous. Before you go into it, consider carefully whether you can afford losing your money.